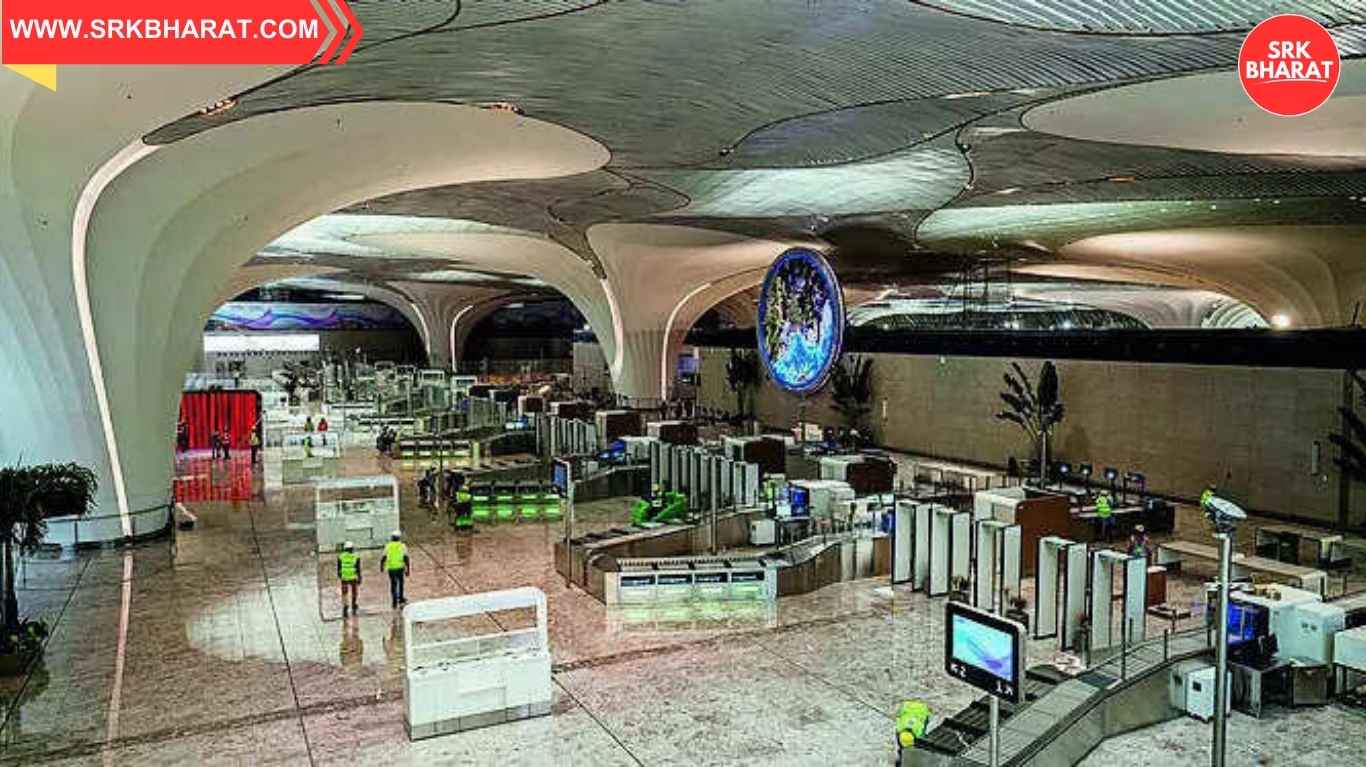

Adani Airport Holdings Limited (AAHL), a subsidiary of the Adani Group, has announced plans to raise Rs 1,500 crore to support the development and operations of six of its airports across India. This move underscores the company’s commitment to strengthening India’s aviation infrastructure and enhancing passenger experience in some of the country’s busiest and strategically important airports.

Background of Adani Airport Holdings

- Adani Airport Holdings is India’s largest private airport operator, managing several key airports including Mumbai, Ahmedabad, Lucknow, Mangaluru, Jaipur, and Guwahati.

- The company has been expanding aggressively, aiming to modernize facilities and improve connectivity.

- The Rs 1,500 crore fundraising initiative is expected to provide liquidity for expansion, modernization, and operational efficiency.

Purpose of the Fundraising

- Infrastructure Development: Upgrading terminals, runways, and passenger amenities.

- Operational Efficiency: Enhancing technology-driven solutions for smoother passenger flow.

- Debt Management: Strengthening financial stability by refinancing existing obligations.

- Future Expansion: Supporting long-term plans for new projects and international collaborations.

Airports Under Focus

| Airport | Location | Planned Investment Focus |

|---|---|---|

| Mumbai | Maharashtra | Terminal expansion, traffic management |

| Ahmedabad | Gujarat | Cargo hub development, passenger facilities |

| Lucknow | Uttar Pradesh | Modernization of terminals, regional connectivity |

| Mangaluru | Karnataka | Coastal tourism boost, runway upgrades |

| Jaipur | Rajasthan | Heritage tourism integration, smart facilities |

| Guwahati | Assam | Northeast connectivity, cargo and logistics hub |

These six airports are strategically located, serving as gateways to major economic and cultural regions of India.

Comparative Analysis of Airport Investments

| Operator | Investment (Rs) | Airports Managed | Strategic Focus |

|---|---|---|---|

| Adani Airports | 1,500 crore | 6 major airports | Modernization, expansion |

| GMR Group | 1,200 crore | Delhi, Hyderabad | International connectivity |

| AAI (Govt) | 800 crore | Regional airports | Domestic connectivity |

| Private Consortia | 600 crore | Select airports | Tourism-driven growth |

This comparison shows Adani’s aggressive investment strategy compared to other operators, positioning it as a leader in India’s private aviation sector.

Impact on India’s Aviation Sector

- Passenger Experience: Improved facilities and faster services.

- Regional Growth: Airports like Guwahati and Lucknow will boost regional economies.

- Tourism: Jaipur and Mangaluru upgrades will attract more domestic and international tourists.

- Cargo Expansion: Ahmedabad and Guwahati will strengthen India’s logistics network.

Challenges Ahead

- Regulatory Approvals: Infrastructure projects require multiple clearances.

- Competition: Other private operators and government initiatives may intensify competition.

- Economic Uncertainty: Global economic conditions could affect passenger traffic and cargo demand.

- Sustainability: Ensuring eco-friendly practices in airport operations is critical.

Conclusion

Adani Airport Holdings’ plan to raise Rs 1,500 crore for six of its airports marks a significant step in India’s aviation growth story. By focusing on modernization, passenger convenience, and cargo expansion, the company aims to transform these airports into world-class hubs.

This initiative not only strengthens Adani’s position in the aviation sector but also contributes to India’s broader goal of becoming a global leader in infrastructure and connectivity.

Disclaimer

This article is based on publicly available information and journalistic analysis of Adani Airport Holdings’ fundraising plans. It is intended for informational purposes only and does not represent insider accounts or official financial documents. Readers should view this as a balanced overview of the situation.