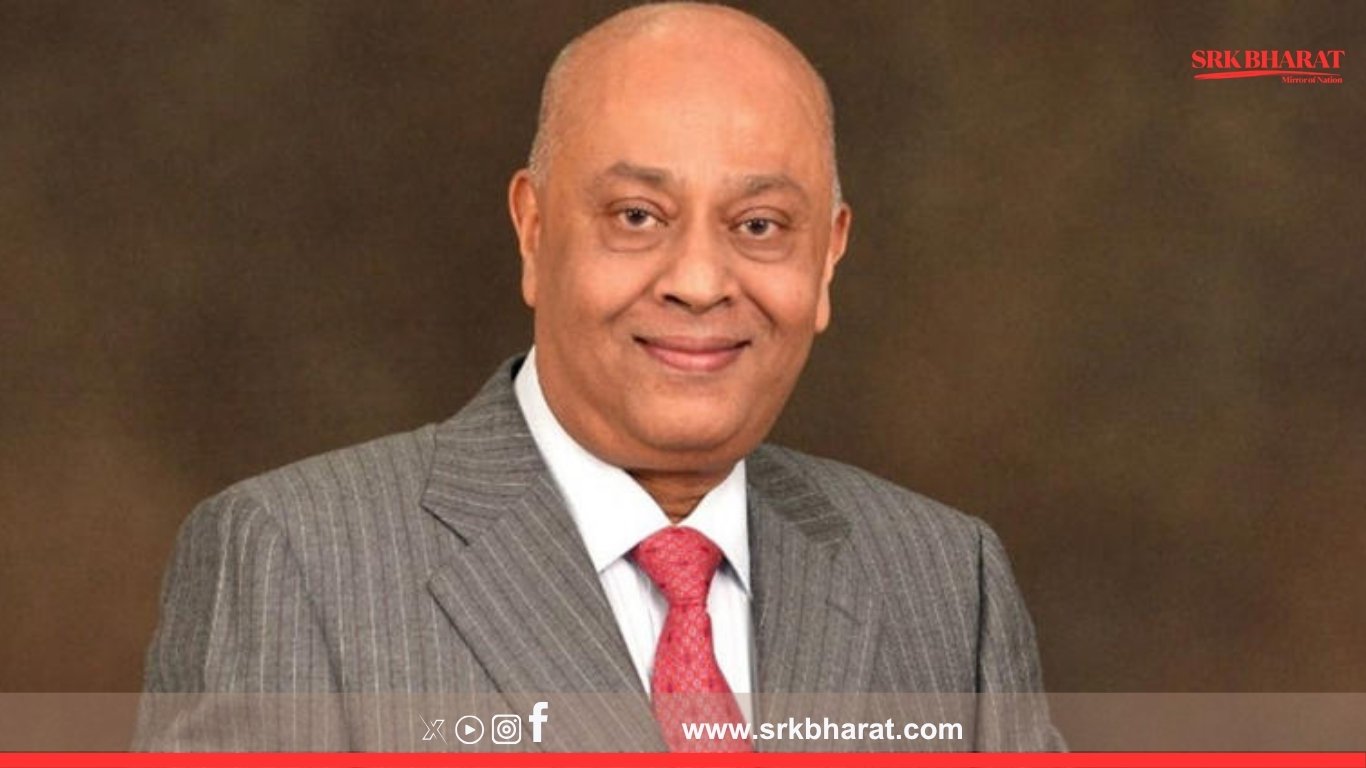

In a major leadership shake-up, Shantanu Mitra, CEO and MD of SMFG India Credit, has announced his exit by the end of June, just as Sumitomo Mitsui Financial Group (SMFG) moves forward with its ₹13,483 crore stake acquisition in Yes Bank.

🔴 Key Highlights:

- Mitra’s resignation comes ahead of SMFG’s proposed merger with Yes Bank, which is awaiting RBI approval.

- SMFG India Credit is a 100% subsidiary of SMFG, operating in home loans, business loans, and personal finance, overlapping with Yes Bank’s lending segments.

- Merging SMFG India Credit with Yes Bank is seen as a strategic necessity, as RBI guidelines prohibit banks from owning subsidiaries in the same lending sector.

- Mitra has served two terms at SMFG India Credit, first from 2010 to 2017, and again from 2021 to 2025.

- The SMFG board is yet to finalize his replacement, with internal discussions underway.

📢 Expert’s Statement:

“Mitra’s exit marks a crucial transition for SMFG India Credit, as the company prepares for structural changes linked to SMFG’s broader financial strategy in India.”

⚠️ Strategic Impact:

- The leadership change could influence SMFG’s integration with Yes Bank, shaping its future lending operations.

- Investors are closely watching RBI’s decision, which will determine the fate of the ₹13,483 crore stake deal.

👉 What do you think? Will SMFG India Credit’s leadership transition impact its merger with Yes Bank? Drop your thoughts in the comments!

🔴 Share this post to keep investors informed! 🚀🔥