India’s largest retail brokerage firm, Zerodha, has rolled out a free support initiative to help investors convert old physical share certificates into digital demat format, even if they are not Zerodha customers. The move, announced by co-founder Nithin Kamath, aims to unlock crores worth of dormant legacy investments and simplify compliance with SEBI’s dematerialisation mandate.

📜 SEBI Rules Make Demat Mandatory

Since April 2019, the Securities and Exchange Board of India (SEBI) has barred the transfer of physical shares, except in cases of inheritance or transmission. However, lakhs of investors still hold paper certificates—many inherited from parents or grandparents—rendering them unusable unless dematerialised.

🛠️ Zerodha’s Step-by-Step Assistance

Zerodha’s new initiative offers:

- Dedicated support team to guide users through documentation and KYC

- Help with registrar coordination and compliance

- No requirement to open a Zerodha account

- Online ticket system to initiate the process via Zerodha’s help portal

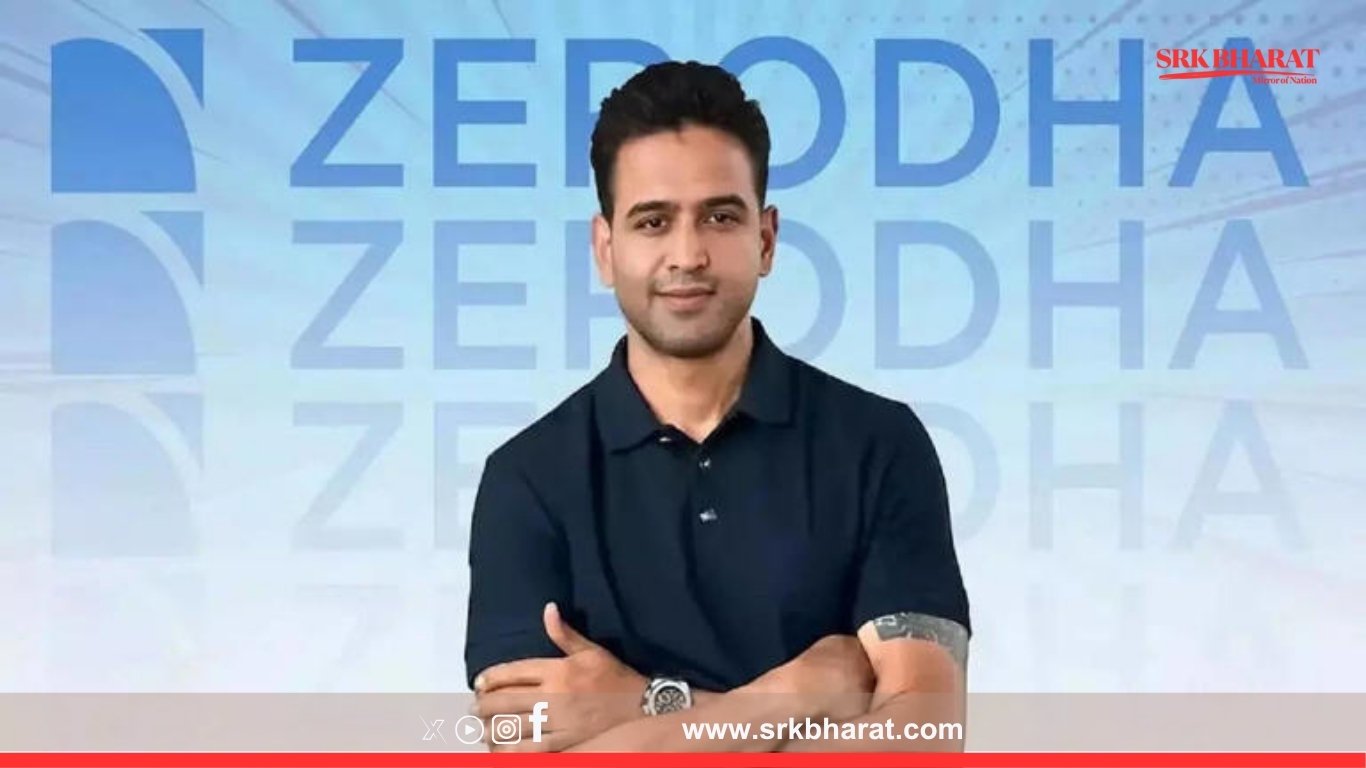

“People often stumble upon old certificates and don’t know what to do next. We realised this is a larger problem and decided to simplify the process—even for non-customers,” Kamath said.

💡 Why Dematerialise?

- Enhanced security: No risk of loss, theft, or damage

- Direct dividends: Credited to your bank account

- Legal compliance: Required for any sale, pledge, or transfer

- Portfolio visibility: All holdings in one digital dashboard

💰 Charges and Timeline

- ₹150 + GST per certificate

- ₹100 + GST courier fee per request

- Processing time: Up to 25 days after document submission

This investor-first initiative is being hailed as a rare example of service-driven outreach in India’s broking ecosystem, especially as second-generation investors increasingly encounter legacy holdings.